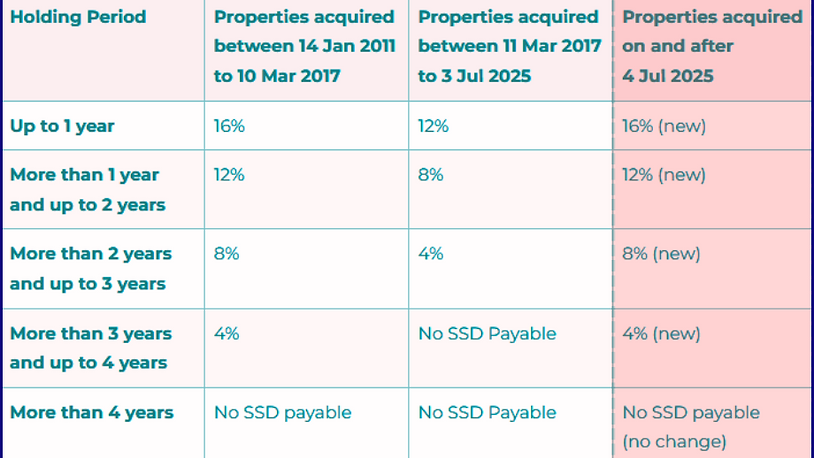

When I ask property owners, “Do you know when your SSD period ends?” the most common response is a blank stare. Many people bought their homes thinking they understood the rules. SSD was for flippers, right? You hold for 3 years, then you’re free to sell without penalty.

Not anymore.

Since July 2025, that “safe zone” has shifted. What used to be a 3-year commitment is now 4 years. That fourth year comes with a 4% tax bill that catches thousands of genuine homeowners completely off guard.

I’m seeing the same pattern repeatedly: families who planned their property moves around the old 3-year timeline are now facing massive unexpected tax bills just for upgrading or relocating when life demands it.

The Seller’s Stamp Duty extension seems minor on paper — just one extra year. But that fourth year now carries a 4% tax on your sale price. For a typical $1.5M condo, that’s $60,000 you’ll pay to the government simply for selling “too early.” (calculation: $1,500,000 × 4% = $60,000)

Here’s the new reality:

Year 1: 16% SSD

Year 2: 12% SSD

Year 3: 8% SSD

Year 4: 4% SSD (This is the new killer)

Year 5+: 0% SSD

The cruel irony? Most genuine homeowners I work with naturally want to upgrade or relocate around the 3-4 year mark. It’s when you’ve settled in, built some equity, and your life circumstances evolve. Now, that natural timing costs you tens of thousands of dollars.

Here are three common scenarios that could affect many property owners:

Imagine a couple who purchase their first 3-bedroom condo in Tampines in August 2025 for $1.2 million. Under previous SSD rules, they could have sold their property after three years without incurring any tax. Now, with the minimum holding period extended to four years, if they decide to upgrade to a landed property in 2028, they would face a 4% Seller’s Stamp Duty (SSD) charge—amounting to $48,000. That’s a significant sum that could otherwise have gone directly into their new home.

Picture an investor acquiring a unit in late 2025 to boost their retirement income. Prior to the SSD changes, selling in 2028 (after three years) would have been penalty-free. Under the new rules, however, the investor must now hold the property for a full four years to avoid SSD. If they need to sell in 2028, just before that threshold, they would be liable for a 4% SSD, which, for a property selling at about $1.38 million, would be roughly $55,000 in additional tax—directly affecting their returns.

Consider a young couple who buy their starter home in September 2025. Life brings a surprise: twins arrive in 2027, and by 2028, they urgently need more space. With the new SSD rules, selling before the four-year mark would subject them to an SSD bill of around $38,000 (assuming a sale price of about $950,000). Under the old 3-year rule, this tax wouldn’t have applied—now it’s a real financial hurdle for families facing unplanned changes.

Every seller’s situation is unique, and that’s exactly how your selling strategy should be. If you’re considering putting your HDB on the market, let’s sit down and work out a timeline that makes sense for you.

I will help you analyse your area’s current supply, understand how interest rates might affect your buyer pool, and identify the optimal timing based on your personal circumstances.

Ready to sell smart? Drop me a message and let’s plan your next move together.

For residential properties purchased *before 4 July 2025, the SSD duration is three years—selling after that period incurs no SSD

These aren’t speculators. They’re hardworking Singaporeans whose life circumstances don’t align with government timelines.

💬 Not sure how this applies to you?

📅 Book a free 15-min SSD Timeline Check with me — no pressure, just clarity

Your SSD timeline starts from when you exercised your Option to Purchase — not when you collected your keys. Here’s what you need to do:

Step 1: Find your OTP date in your property documents.

Step 2: Add exactly 4 years to that date.

Step 3: If you’re planning to sell before that date, you’ll pay SSD.

Critical timing note: Remember that property sales take 2-3 months from listing to completion. If your 4-year mark is in the next 6 months, you need to decide now whether to proceed or wait.

Option 1: Pay the SSD

Sometimes it still makes sense. If your property has appreciated significantly, or life circumstances demand it, the tax might be worth paying. But run all the numbers first.

Option 2: Rent It Out Temporarily

Can’t sell but need to move? Rent out your current place while renting elsewhere. You’ll manage two properties temporarily, but you avoid the SSD hit.

Option 3: Wait It Out

If you have flexibility, patience might save you $60,000. That’s real money worth considering.

Option 4: Creative Solutions

Sometimes smart renovations or temporary family arrangements can bridge the gap better than paying massive taxes.

Many clients focus only on the SSD percentage, but the real impact includes:

SSD: 4% of sale price

Agent commission: ~1-2%

Legal fees: ~ $3,000

CPF refund requirements: Often substantial

Opportunity cost of rushed decisions

For a typical client selling a $1.1M condo, the total costs would be nearly $70,000 — money that should go toward their family’s future, not government coffers.

As your property advisor, my job isn’t just to facilitate transactions — it’s to help you make smart long-term decisions. Here’s my honest advice:

If you’re buying now: Factor in a 4-year minimum hold. Don’t stretch financially assuming you can exit quickly.

If you’re in the SSD period: Start planning early. Explore all options before making rushed decisions.

If you must sell early: Let’s model different scenarios together. Sometimes paying SSD is still the right choice, but let’s make sure.

This SSD extension isn’t going anywhere. The government has consistently tightened cooling measures over the years, rarely loosening them. This means:

Property decisions now require longer-term thinking

Upgrade timing has become more critical

Alternative strategies (like renting out) become more attractive

Professional guidance is more valuable than ever

In my three years helping Singapore families with their property decisions, I’ve learned something crucial: honest advice builds lasting relationships, not quick transactions.

When clients ask about selling during their SSD period, my first question isn’t “When can we list?” — it’s “What are all your options?” Sometimes that means talking someone out of a sale entirely.

Because here’s what I believe: Your family’s long-term financial health matters more than any commission. If waiting six months saves you $60,000, that’s what I’ll recommend — even if it means no deal for me today.

My commitment is straightforward:

I’ll calculate your exact SSD timeline and all associated costs.

We’ll explore every alternative before rushing into expensive decisions.

You’ll get my honest assessment, even when it’s not what you want to hear.

No pressure tactics, no artificial urgency — just clear options and real numbers.

Need clarity on your SSD situation? I offer no-obligation consultations where we’ll map out your timeline and discuss all your options. No sales pitch — just honest guidance to help you make the best decision for your family’s future.

Let’s avoid a costly mistake. I’ll give you a clear breakdown, no sales pitch.

Copyright © 2025 Constantine Koh. All rights reserved